iowa capital gains tax farmland

NW IR-6526 Washington DC 20224. Enacted Legislation including via incorporation There are 565 enacted bills including bills and joint resolutions identical to or incorporated into enacted legislation based on an automated GovTrackus data analyis.

The Lost Art Of Using A Land Contract For Buying Selling Farmland Next Gen Ag Advocates

The university is celebrating 75 years its diamond anniversary.

. If youre looking for background information on how capital gains tax on land sales may impact your inheritance. Get the latest international news and world events from Asia Europe the Middle East and more. Printable Wisconsin state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

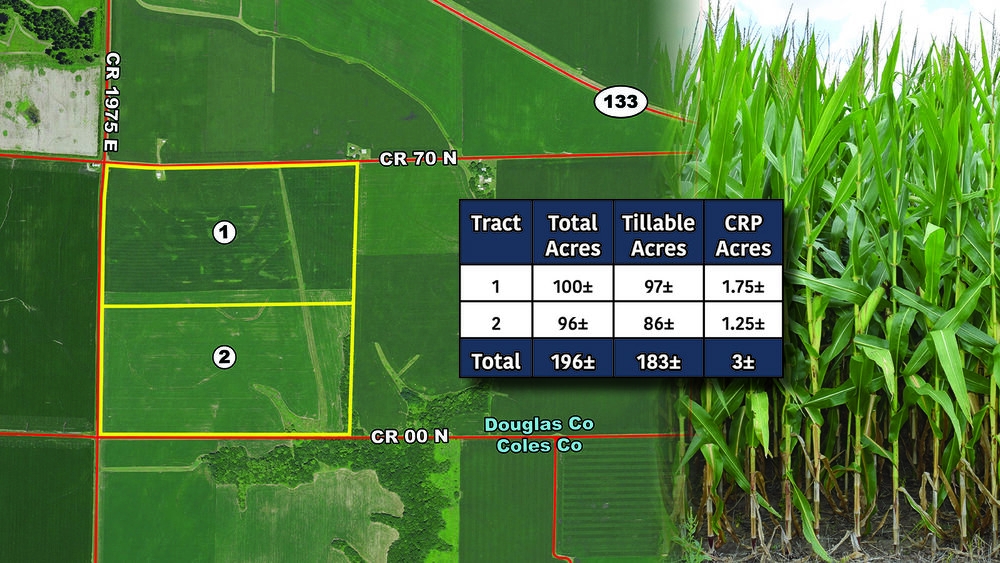

The Company or FPI today announced the acquisition of two Illinois farms totaling 485 acres. Individuals who make an election under this section may not. The Jerusalem Post Customer Service Center can be contacted with any questions or requests.

Mizeur Democratic Party was a member of the Maryland House of Delegates representing District 20. Beginning in tax year 2023 Iowa farmers age 55 and older who farmed for at least 10 years but have retired from farming operations can elect an exemption of income from either cash rent or farm crop shares for all years the income is earned. Capital gains tax and estate tax.

You can send us comments through IRSgovFormCommentsOr you can write to. The 0 capital gains tax rete applies to the amount of capital gains that is taxed in the 15 or lower tax bracket. Test your knowledge with over 6295 fun Geography Quizzes.

We welcome your comments about this publication and suggestions for future editions. Or elect one lifetime election to exclude the net capital gains from the sale of farmland. Sacramento State is back in session and its a big year.

A taxpayer would calculate all of their other ordinary income after deductions and if this amount is less than 72000 then the difference would be the. For example if you are to start a Wyoming LLC then you can raise business capital of. The short answer is that just receiving land as an inheritance usually will not trigger income taxes for you but you will owe capital gains taxes if you sell the property later at a gain.

Both can influence the portion of your net worth that survives your death. In comparison between 2010 and 2014 the average annual growth in value was 40. Play a Geography Quiz on Sporcle the worlds largest quiz community.

The Wisconsin income tax rate for tax year 2021 is progressive from a low of 354 to a high of 765. Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. House to represent Marylands 1st Congressional DistrictShe is on the ballot in the general election on November 8 2022She advanced from the Democratic primary on July 19 2022.

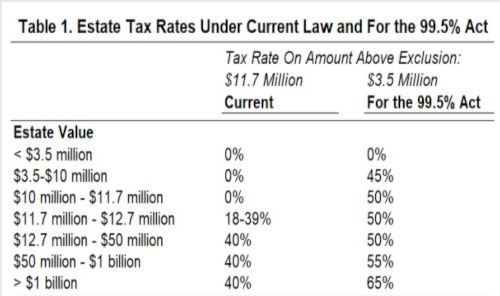

The state income tax table can be found inside the Wisconsin Form 1 instructions booklet. Chans company helps people who normally wouldnt have the capital to invest in farmland enter the market typically by purchasing a. To better understand how estate tax is defined and calculated visit this article from Iowa.

The residence halls are full and if youve been anywhere near Sac State. A 2018 survey of Iowan farmers found that 53 percent of Iowa farmland is rented. Bill Title Introduced Latest Action AB 2687 2021-2022 Regular Session California Massage Therapy Council.

The development which extends across six FPI properties spanning 1542 acres will. Compare the pros and cons and review tax consequences of farm sales. FPI the Company or FPI today announced it received notice that a renewable energy tenant plans to begin construction of a new solar power project in Clark County Illinois by the end of the month.

Apply the Iowa capital gain deduction to proceeds from the sale of farm in the current or succeeding tax years see Division III below for new relevant law. DENVER August 24 2022--BUSINESS WIRE--Farmland Partners Inc. The latest farmland values in Iowa eastern Kansas Nebraska South Dakota and Wyoming.

Farmland Values Continue Steady but Gradual Decline Unlike last year when a strong livestock market led to increased demand for pastureland values on both pasture and cropland are generally down in 2016. Significantly this tax would only be applicable to the difference between the fair market value of the land when the benefactor died and what you sell it for. Adding the capital gains of 1 to a rental income of about 325 1 gave Wisconsin land owners an average annual return on investment of 425 for the 2015-2021 period.

Between 2015 and 2021 the average annual growth in Wisconsin agricultural land value was 275. The law directs the Iowa Department of Revenue to create rules to determine when a surviving spouse can claim the income deduction. 2421 Extension 4 Jerusalem Post or 03-7619056 Fax.

Tax increment financing TIF is a public financing method that is used as a subsidy for redevelopment infrastructure and other community-improvement projects in many countries including the United StatesThe original intent of a TIF program is to stimulate private investment in a blighted area that has been designated to be in need of economic revitalization. Heather Mizeur Democratic Party is running for election to the US. DENVER August 03 2022--Farmland Partners Inc.

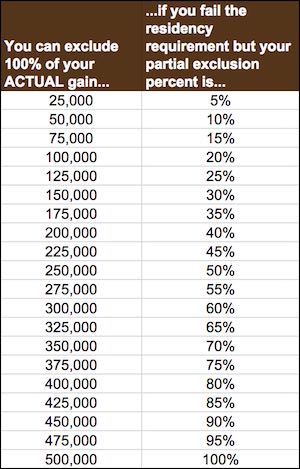

In addition to these tax benefits you can also get an exemption for the first 500000 worth of capital gains earned from the sale of your farm. What is an estate tax on the sale of farmland. Here is a breakdown of all 15916 bills and resolutions currently before Congress.

The cut-off for a married couple in 2013 is about 72000 of taxable income.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The Lost Art Of Using A Land Contract For Buying Selling Farmland Next Gen Ag Advocates

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

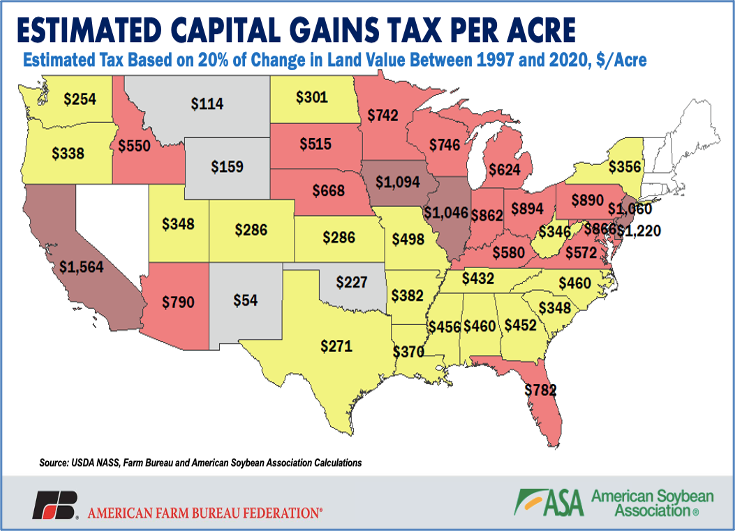

624 Acre Tax Increase In Michigan Without Stepped Up Basis Michigan Farm News

Biden Plan Could Force Iowa Family Farms To Sell To Pay Federal Tax The Iowa Torch

624 Acre Tax Increase In Michigan Without Stepped Up Basis Michigan Farm News

Iowa Tax Law Makes Some Changes Now But Others Are Far Off And Contingent Center For Agricultural Law And Taxation

The Lost Art Of Using A Land Contract For Buying Selling Farmland Next Gen Ag Advocates

The Experiment To Finance The Future Of American Farming Time

Ag Groups Say Sec Rules Threaten Future Of Small Mid Size Farms 2022 06 21 Agri Pulse Communications Inc

The Lost Art Of Using A Land Contract For Buying Selling Farmland Next Gen Ag Advocates

624 Acre Tax Increase In Michigan Without Stepped Up Basis Michigan Farm News

624 Acre Tax Increase In Michigan Without Stepped Up Basis Michigan Farm News

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Tax On Farm Estates And Inherited Gains Farms Com

624 Acre Tax Increase In Michigan Without Stepped Up Basis Michigan Farm News

624 Acre Tax Increase In Michigan Without Stepped Up Basis Michigan Farm News